In 2023, the U.S. business jet market exhibited a dynamic mix of established brands and emerging models. The JetSpy platform offers comprehensive insights into the utilization of various makes and models, preferences across different jet classes, and the most active aircraft models. This data provides a detailed and up-to-date overview of the business aviation landscape in the United States.

2023 vs 2022

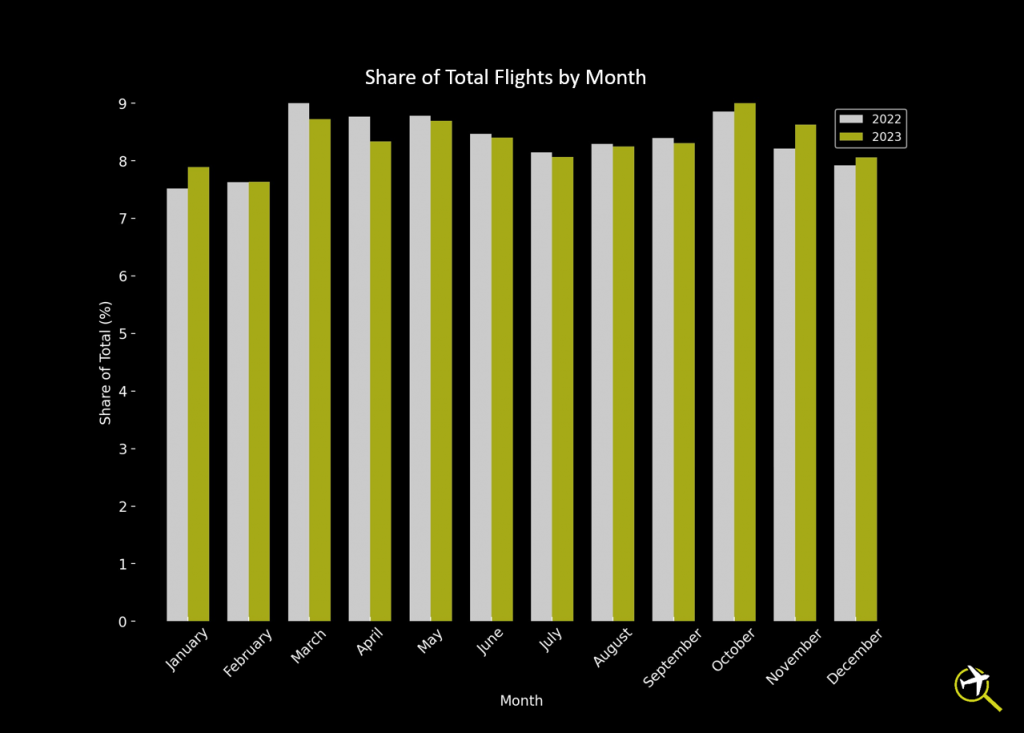

In a year-over-year comparison, the business jet fleet’s monthly flight distribution in 2023 was fairly consistent with 2022’s patterns. This suggests that the business aviation sector maintained a steady operational tempo throughout the year, resilient against the ebbs and flows that often characterize commercial aviation.

Despite this overall stability, the chart uncovers nuanced shifts in the landscape. In particular, certain months in 2023 stand out, having deviated from the previous year’s flight share. For instance, November 2023 marks itself as a month of growth, reflecting a higher proportion of the year’s flights than the same month in the preceding year. This could signal an evolving preference for travel periods or a response to economic variables affecting flight demand.

The data points toward a business aviation industry that is not static but is responsive to underlying market forces. Such insights are important for industry stakeholders, from operators to service providers, who look to optimize their offerings and strategies in alignment with emerging trends.

Flight Hours:

- The combined flight time across all FAA-registered business jets decreased by 169,154 hours (4%) from 2022 to 2023, which shows a contraction in the business aviation market or changes in usage patterns.

- The overall reduction in flight hours is likely influenced by economic factors or additional changes within business aviation.

Notable Events of 2023

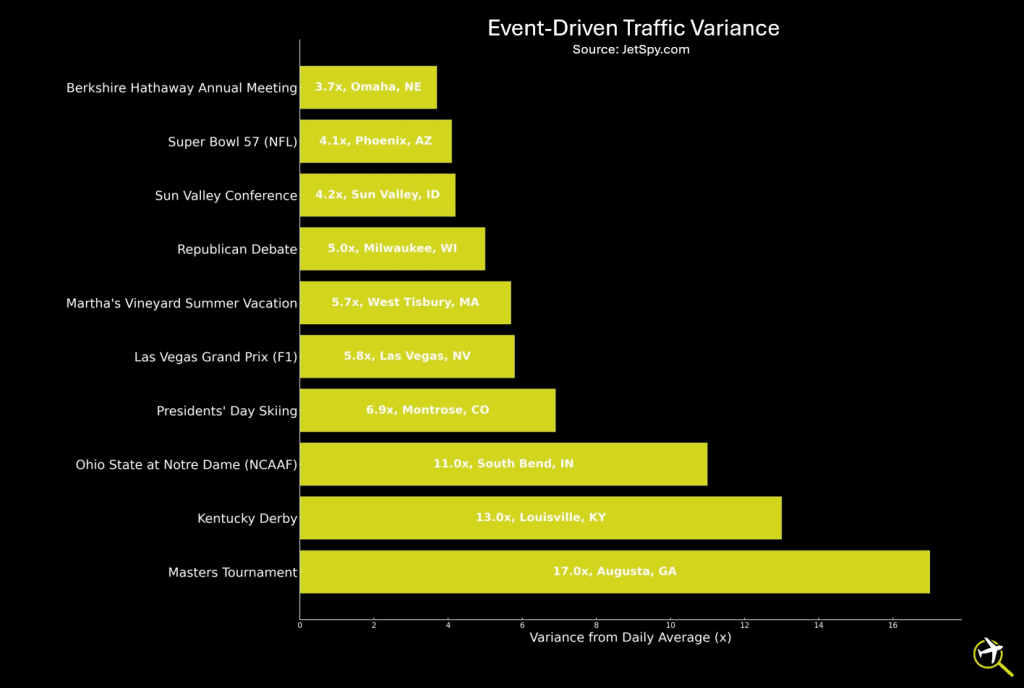

The chart below highlights the fluctuation in private jet traffic compared to the local daily average, with each bar reflecting the increase in activity at FBO airports during these specific events. The vertical bars represent the increase in the number of flights, providing a clear comparison of traffic volume variance across different occasions.

The Masters Tournament in Augusta, GA, stands out with the highest daily variance, indicating a significant surge in private jet traffic as players, affluent patrons and golf enthusiasts converge for this prestigious event. The Kentucky Derby and the Las Vegas Grand Prix also display significant spikes in business jet traffic. These events are social highlights of the year, attracting a high net-worth demographic that often prefers the speed and privacy of private jet travel.

The data also reveals heightened activity for the Sun Valley Conference in Idaho, a renowned gathering of media and technology moguls, and the Berkshire Hathaway Annual Meeting in Omaha, NE, famously led by Warren Buffett. These occasions are key dates in the corporate calendar, where time-sensitive travel is best served by the agility of private aviation. The chart not only reflects the logistical preferences for attending such elite events but also hints at the logistical challenges these spikes in demand can present for FBOs and other aviation service providers.

Market Movements

Active Aircraft – Established:

- Gulfstream, Cessna, and Bombardier saw an increase in active aircraft, indicating a positive trend in their market presence.

- Gulfstream leads with an additional 132 aircraft (5.12% fleet growth), followed by Cessna with 117 (2.13% fleet growth), and Bombardier with 108 (5.74% fleet growth).

- Learjet, which has not seen new models produced since Bombardier ended production in early 2021, saw a decrease with 47 fewer active aircraft (4.19% fleet decline).

Active Aircraft – Emerging:

- Embraer, Cirrus, and Pilatus have experienced significant increases in their active aircraft, signaling a robust expansion in their respective market shares.

- Embraer leads with an additional 88 aircraft (9.28% fleet growth), followed closely by Cirrus with 87 (22.03% fleet growth), and Pilatus with 31 (33.33% fleet growth).

Active Aircraft includes all aircraft with at least one flight in the calendar year.

These changes reflect shifts in the business aviation market, with certain OEMs and aircraft models gaining prominence while others see reduced activity. The data suggests trends towards newer or more efficient models.

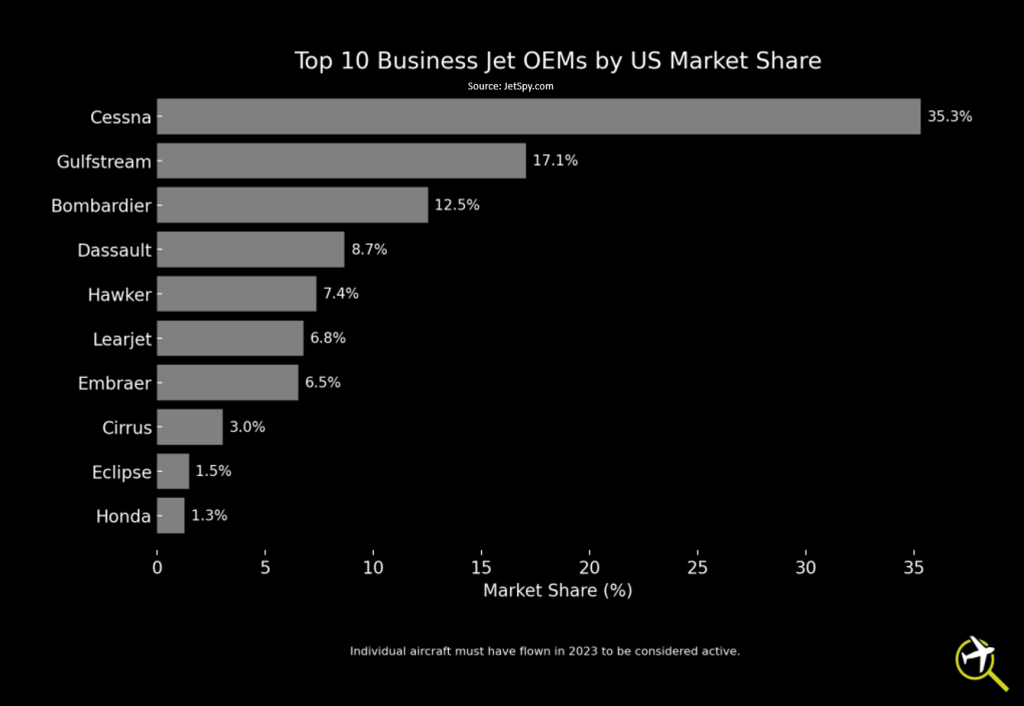

Top OEMs by U.S. Market Share for 2023

The U.S. business jet market is a competitive arena where a few key players dominate. Cessna leads with a 35% market share, attributed to its diverse range of efficient and versatile jets. Following are Gulfstream and Bombardier, with 17% and 12% market share respectively, known for their luxury and long-range capabilities. Dassault and Hawker also make significant contributions to the market. These manufacturers have shaped the landscape of business aviation with their innovative designs and advanced technology.

This chart visualizes the market shares of the top 10 business jet manufacturers, strictly considering FAA-registered jet aircraft that flew in 2023.

OEM Market Share by Jet Class

Delving deeper into the specifics of each jet class, we see distinct leaders in each category. These are the domestic market shares of the top 3 manufacturers by active aircraft in 2023:

Ultra Long Range Jet Class

- Gulfstream: 67%

- Bombardier: 26%

- Dassault: 7%

- Dominant Model: Gulfstream G550

- Gulfstream’s G550 is renowned in the ultra-long-range jet class for its exceptional range, speed, and luxury. It’s favored for its spacious cabin, advanced technology, and long-haul capability, making it a top choice for international travel.

Heavy Jet Class

- Bombardier: 40%

- Gulfstream: 29%

- Dassault: 27%

- Dominant Model: Bombardier Challenger 600

- The Bombardier Challenger 600 series stands out in the heavy jet class for its spacious cabin and long-range capabilities. It’s designed for comfort and efficiency, offering a luxurious experience for business and leisure travel.

Super Midsize Jet Class

- Bombardier: 33%

- Dassault: 30%

- Gulfstream: 19%

- Dominant Model: Bombardier Challenger 300

- The Challenger 300 stands out in the super midsize class for its blend of range, speed, and luxury. With a spacious cabin and advanced flight deck, it’s tailored for both business and leisure travel, offering comfort and efficiency.

Midsize Jet Class

- Cessna: 61%

- Learjet: 17%

- Hawker: 11%

- Dominant Model: Cessna Citation V/Ultra/Encore

- Description: The Cessna Citation V series, including the Ultra and Encore models, is prominent in the midsize jet class. These jets are known for their balance of performance, comfort, and efficiency, making them suitable for both business and leisure travel.

Light Jet Class

- Cessna: 51%

- Embraer: 19%

- Hawker: 14%

- Dominant Model: Cessna CitationJet

- The Cessna CitationJet series leads in the light jet class with its compact size, economy, and versatility. Ideal for shorter trips, these jets provide a cost-effective and comfortable way to travel for both business and personal purposes.

Very Light Jet Class

- Cirrus: 48%

- Cessna: 29%

- Eclipse: 23%

- Dominant Model: Cirrus Vision Jet

- The Cirrus Vision Jet revolutionizes the very light jet class with its single-engine design and advanced avionics. This personal jet is known for its affordability, ease of operation, and innovative safety features, making private flying more accessible.

Top 5 Business Jets by Total Flights in 2023

- Cessna CitationJet (Light Class):

- 273,522 flights

- The CitationJet series, known for its efficiency and economy, leads in total flights. This series, launched in the early 1990s, offers a balance of performance and operational cost, making it ideal for short to medium-range flights. Price ranges vary from $2 million to over $10 million depending on the model and year.

- Cessna Citation V/Ultra/Encore (Midsize Class):

- 255,912 flights

- These midsize jets are popular for their spacious cabins and longer range. Introduced in the late 1980s, the series has evolved with advanced avionics and more efficient engines. They are priced between $3.5 million and $8 million.

- Cessna Citation Sovereign (Midsize Class):

- 200,982 flights

- Known for its longer range and spacious cabin, the Sovereign is a mainstay in midsize travel. Launched in 2004, it’s designed for transcontinental flights, blending performance and luxury. Prices range around $18 million for new models.

- Bombardier Challenger 300 (Super Midsize Class):

- 197,101 flights

- The Challenger 300, introduced in the early 2000s, stands out for its range and cabin comfort. It’s a preferred choice for longer domestic and transatlantic flights. The price for a new Challenger 300 is around $20 to $25 million.

- Embraer Phenom 300 (Light Class):

- 173,823 flights

- This light jet, launched in 2009, is known for its speed, range, and cabin space. Ideal for both business and leisure, the Phenom 300 can be priced around $9 million new, offering advanced technology in a compact size.

Top 5 Business Jets by Average Total Flight Time in 2023

- Embraer Legacy 450/Praetor 500 (Midsize Class):

- Average Flight Time per Jet: 570 hours

- This series stands out for its remarkable range and comfort, positioning it as a favored choice for extended-range domestic journeys.

- Cessna Citation Longitude (Midsize Class):

- Average Flight Time per Jet: 550 hours

- Offers enhanced range capabilities, making it an excellent aircraft for extended domestic trips, bridging cities with ease and comfort.

- Cessna Citation Sovereign (Midsize Class):

- Average Flight Time per Jet: 457 hours

- The Sovereign’s blend of range and cabin amenities makes it a preferred jet for longer, comfortable journeys, reflected in its high total flight time.

- Bombardier Challenger 300 (Super Midsize Class):

- Average Flight Time per Jet: 416 hours

- Its balance of comfort and performance for longer flights makes the Challenger 300 a popular choice for extensive use, contributing to its significant total flight time.

- Embraer Phenom 300 (Light Class):

- Average Flight Time per Jet: 413 hours

- The Phenom 300’s popularity for both business and leisure travel, combined with its range and speed, contribute to its significant total flight time.

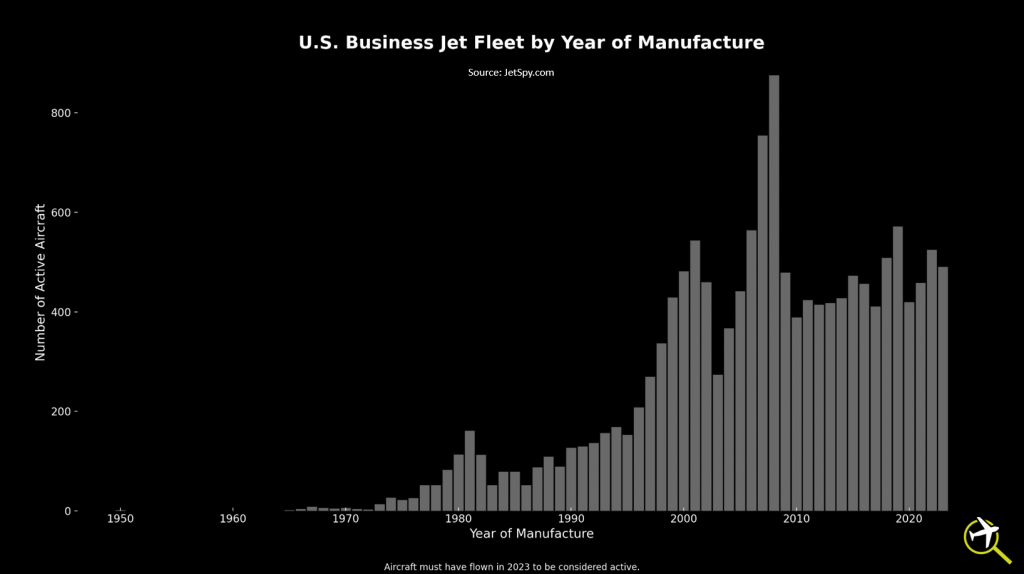

2023 Business Jet Fleet Aging

Fleet aging data showcases trends in the business aviation industry, reflecting economic cycles, technological advancements, and market demand. It provides insight into periods of significant growth, stability, and potential decline, which can be linked to a myriad of factors, from innovation in jet technology to global economic health. Further, This dataset helps identify the staying power of various model years and can suggest trends in the durability of the aircraft, maintenance practices, and the evolving needs and preferences of the business aviation sector.

Conclusions:

- Durability of Aircraft Models: Peaks in the graph may indicate model years that have proven to be particularly durable or popular over time.

- Technological Milestones: Certain model years with higher numbers of active aircraft may correspond to the introduction of significant technological advancements, leading to longer operational life.

- Operational Costs: Variations in active aircraft numbers could reflect changes in operational costs over time, including maintenance, fuel efficiency, and upgrades.

- Lifecycle Trends: Trends in the graph can show how the lifecycle of a business jet has evolved over time, further extending as technology improves.

- Retrofits and Upgrades: The longevity of certain model years is likely due to the availability and prevalence of retrofitting these older jets with new technology, extending their operational life.

These points reflect how the age distribution of currently active business jets can offer insights into the history and future directions of the business aviation industry. The data can assist in understanding the economic and practical factors influencing the operational lifespan of business jets.

JetSpy: Your Window to Business Aviation Data

JetSpy’s advanced tracking and analytics platform is a valuable asset for various stakeholders in the business aviation and financial industries. From airport operations teams and FBOs, to aircraft manufacturers, charter companies, brokers, analysts, underwriters, and other financial professionals, JetSpy provides comprehensive and efficient access to business aviation data.

Create a free account or subscribe for more in-depth access, including live flight tracking & alerts, flight history, operating stats, route & utilization analysis, and more. JetSpy offers three subscription plans: Scout to unlock individual aircraft, Controller to unlock all aircraft, and Authority to add route search & utilization analysis capabilities.

Organizations can receive multi-user discounts by submitting an inquiry.